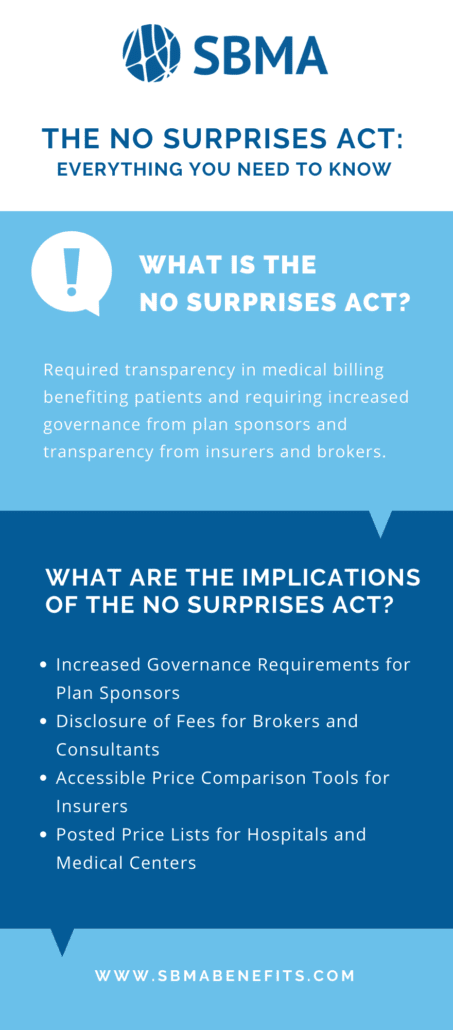

WHAT IS THE NO SURPRISES ACT?

The No Surprises Act (NSA) The NSA went into effect January 2022. This new law addresses surprise medical billing and requires new disclosures for employers, third party administrators (TPAs), brokers, and all participants in the healthcare industry including, but not limited to:

- Hospitals

- Hospital outpatient departments

- Ambulatory surgical centers

- Payors

- Providers

- Facilities

- Ancillary providers performing emergency and non-emergency services

“[Surprise medical bills can] arise in an emergency when the patient has no ability to select the emergency room, treating physicians, or ambulance providers. Surprise medical bills might also arise when a patient receives planned care from an in-network provider (often, a hospital or ambulatory care facility), but other treating providers brought in to participate in the patient’s care are not in the same network.

These can include anesthesiologists, radiologists, pathologists, surgical assistants, and others. In some cases, entire departments within an in-network facility may be operated by subcontractors who don’t participate in the same network. In these non-emergency situations, too, the in-network provider or facility generally arranges for the other treating providers, not the patient.”*

*Surprise Medical Bills, Karen Pollitz (Mar. 17, 2016). https://www.kff.org/private-insurance/issue-brief/surprise-medical-bills/

WHAT ARE THE IMPLICATIONS OF THE NO SURPRISES ACT?

The Consolidated Appropriations Act (CAA), 2021 made major changes in the way that group health plans are regulated and operated. The addition of the No Surprises Act of 2022 adds complex new rules aimed at protecting against surprise billing and beefs up overall group health plan transparency. The many provisions require that plans provide:

- A robust online price comparison tool

- Advance explanations of benefits (EOBs)

- Report claims information to state “all-payer claims” databases

- Improve the accuracy of plan provider directory information

- Remove gag clauses in vendor contracts

- Examine and document compliance with mental health and substance standards

- Report on pharmacy costs.

In addition, brokers and consultants to group health plans must disclose to plan fiduciaries the direct and indirect compensation they are paid each year.

Collectively, these new rules impose potentially significant new regulatory and litigation risks on sponsors of group health plans. They also raise the standard for advisors who must keep their clients up to date on, and in compliance with, these new rules.

The new regulation takes the employee out of covering the cost of unexpected medical bills and puts processes in place for employers, insurers, and hospitals to resolve payment responsibilities for out-of-network medical bills. The goal of the No Surprises Act is to support individuals who receive emergency or needed medical services, but end up with a heavy medical bill that puts them in high unexpected debt.

The new NSA regulations will create increased transparency in medical billing by providing coverage price lists, and potentially creating flat and/or set rates for medical services. The result of the NSA will be that insured individuals who receive medical treatment will not receive higher than expected bills for the treatments they are given.

What Will the No Surprises Act Mean for Patients?

LET’S FRAME THIS AS A STORY:

Andrew falls off the roof cleaning the gutters, the ambulance comes and takes him to the hospital where he is treated for emergency care by an anesthesiologist, a surgeon, and then, post-surgery receives rehabilitation care from a physical therapist. The anesthesiologist is out of network, the surgeon is in-network and the PT is out of network. The hospital sends a bill to the insurer for $7,100.00.

The insurer will have an agreed-upon contractual rate that is less than the billed amount, in this case, let’s set that at $4,600.00. Andrew has insurance with a $1,000 deductible and a 20% co-pay, so he owes $1,720.00. The insurance pays the difference between Andrew’s responsibility and the agreed-upon amount (Contractual Rate) of $4,600.00, so the insurer pays the hospital $2,880.00.

Before the NSA, the hospital would then bill Andrew not only the $1,720 of his deductible + 20% co-pay but also the additional $2,500.00 to make up the difference between their billed amount and the agreed-upon Plan Recognized amount of $4,600.00. This brings Andrew’s total payment burden to $4,220.00.

The No Surprises Act would eliminate the ability for hospitals to collect the difference between the Plan Recognized amount and their higher bill.