The Affordable Care Act (ACA), created in 2010, was designed to ensure healthcare is affordable and available to more people.

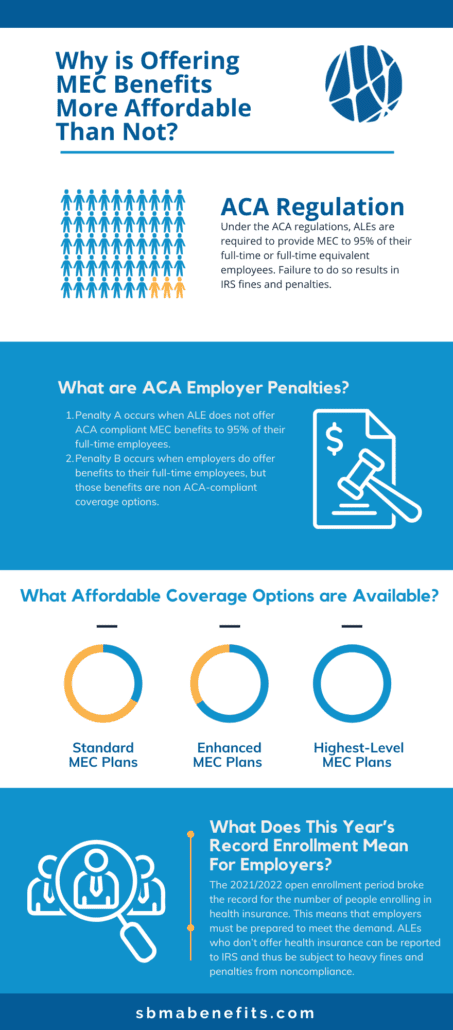

Under ACA regulations, applicable large employers (ALEs) are required to provide minimum essential coverage (MEC) to 95% of their full-time or full-time equivalent employees (someone who works at least 30 hours per week). Companies who qualify as ALEs have at least about 50 full-time employees in a calendar year.

If you fail to provide minimum essential coverage to 95% of your full-time employees, your company is subject to various penalties that could cost your business.

If you do a cost-benefit analysis, investing in MEC for your employees can save you millions, while also increasing employee engagement.

How Do You Determine Employee Benefit Eligibility?

There are two methods for ALEs to determine employee benefit eligibility. They include the following:

- Monthly Measurement Method

- Look Back Measurement Method

In the monthly measurement method, an employer must count the total hours each employee worked per calendar year. If they worked more than 130 hours in one calendar year, they are automatically considered an employee who should be eligible for employer benefits.

On the other hand, the look back measurement method looks at the employee’s future employment status to determine benefit eligibility. It assesses the stability period and the predicted hours the employee will work monthly.

Both methods help employers calculate benefit eligibility to avoid fines for failing to offer federally mandated benefits to their workforce.

Other advantages of offering ACA benefits include:

- Providing affordable health insurance to your workforce

- Placing an emphasis on preventative care to maintain a healthy workforce

- Improving health care delivery

What Are ACA Employer Penalties?

ACA employer penalties are fines issued by the Internal Revenue Service (IRS) to non-compliant ALEs. The IRS takes non-compliance seriously and issues higher penalty amounts, according to the ACA times.

The two penalties they can issue are Penalty A and Penalty B. ALEs will receive one or the other, not both simultaneously.

PENALTY A

Penalty A occurs when ALEs do not offer ACA-compliant MEC benefits to 95% of their full-time employees along with their dependents.

The IRS will issue a fine for every full-time employee, excluding the first 30 employees, who are not offered ACA benefits. Fine amounts vary depending on the tax year IRS penalizes. The 2021 tax year penalties will be $2,700.

PENALTY B

Penalty B occurs when employers do offer benefits to their full-time employees, but those benefits are non-ACA-compliant coverage options. Fines issued for Penalty B are $4,060 per employee for the 2021 tax year for ALEs who issued non-compliant insurance options.

These fines aren’t worth the monetary financial burden of failing to provide ACA-compliant MEC benefits to your employees.

Continue reading to learn about the affordable coverage options available to you as an employer, and how much you will save by providing MEC benefits.