Navigating insurance policies can be challenging for anyone. There isn’t a way to predict the future, so how can you know what you will need? There are so many options available, how can you decide?

Voluntary benefits can help supplement insurance policies that may not cover all of your employees’ needs. There are many options when it comes to voluntary benefits with a few differences. What’s the difference between hospital indemnity policies and accident insurance? Here’s a breakdown.

ACCIDENT INSURANCE

Accident insurance is an option to help supplement out-of-pocket expenses for potential expenses incurred when an accident occurs. This insurance is used to cover expenses that your standard health insurance plan cannot cover.

Typical medical insurance directly pays the medical provider, and you receive the bill later. Accident insurance, on the other hand, pays the cash directly to you, then you choose the best way to use that money.

WHAT EXACTLY DOES AN ACCIDENT INSURANCE POLICY COVER?

There are quite a few expenses accident insurance covers that your traditional health insurance plan may not. These can include:

- Emergency room visits

- Ambulance rides

- Helicopter transportation

- Hospital admission charges

- Diagnostic exams

- Follow-up treatments

- ICU and rehabilitation unit care

- Physical therapy

Ambulance transportation can be extremely expensive. Investing in accident insurance could save you thousands of dollars.

Deductibles for many medical insurance plans can also cost thousands. Other insurance simply doesn’t cover hospital stays, ambulance rides, or other non-preventative care. Accident insurance can be a great backup plan.

How Much Does My Insurance Go Up After an Accident?

Unlike claims filed for car insurance or homeowner’s insurance, the premiums on accident insurance do not increase after an accident or diagnosis of an illness. In other words, covering an ambulance ride with insurance will not impact the premium.

The Affordable Care Act (ACA), created in 2010, halted any insurers’ ability to adjust insurance rates due to medical history or gender.

Now, once you are insured, your premiums will not increase as a result of filing a claim. However, premiums increase steadily over time due to healthcare inflation, increased prescription costs, and rises in chronic illnesses. Many insurance policies implement a fixed annual rate increase that in no way is based on claims filed on accidents.

As Verywell Health explains, “the overall rates for everyone on the plan will typically go up from one year to the next, based on the total claims that were filed by everyone on the plan. But they’ll go up by the same percentage for people who filed big claims, people who filed small claims, and people who filed no claims at all.” Rates reflect the usage of the group, not the individual.

WHAT IS HOSPITAL INDEMNITY INSURANCE?

Hospital indemnity insurance is very similar to accident insurance. Whether you choose one over the other or get both will depend on your lifestyle, expenses, and savings. It is also used to supplement any expenses incurred outside of your health coverage.

Hospital indemnity insurance provides a set cash payment to use for any bills you need to pay. This is especially helpful for paying housing, bills, and living expenses if you are unable to work.

WHAT DOES HOSPITAL INDEMNITY INSURANCE COVER?

Hospital indemnity insurance coverage depends on the plan and coverage options you choose. Some things covered under a typical hospital indemnity plan include:

- ICU stays

- Critical care unit stays

- Outpatient surgery

- Continuous care

- Outpatient x-rays

- Laboratory procedures

- Outpatient diagnostic imaging procedures

- Ambulances

- Emergency rooms

- Physician office visits

Generally, hospital indemnity plans have lower premiums compared to other insurance, but depending on your coverage that can increase.

Is Hospital Indemnity Insurance Worth It?

It’s important to consider your own personal health and wellbeing when deciding on purchasing hospital indemnity insurance. Since this insurance does not cover typical doctor’s visits or prescription medication, it really depends on you and your lifestyle.

Keep in mind:

- Your personal health—are you or your family members more likely to be hospitalized?

- What level of coverage does your current health insurance plan cover?

- Are you financially able to cover unexpected health costs?

- How much would a hospital indemnity plan cost over time vs. the cost of benefits received?

This plan may give you peace of mind, and the support you need during an unexpected accident. However, if the plan does not seem like something you need, or if you are able to cover the price of an emergency out-of-pocket, you may not need hospital indemnity insurance.

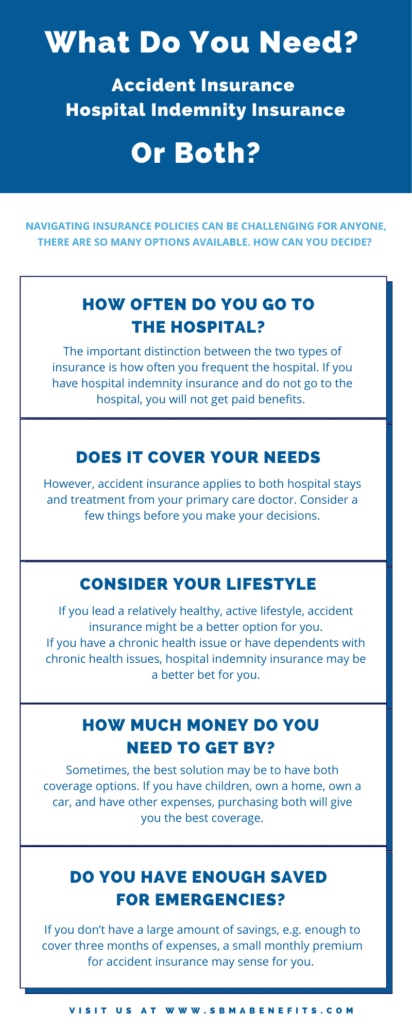

SO, HOW DO YOU DECIDE WHICH COVERAGE TO INVEST IN?

The important distinction between the two types of insurance is how often you frequent the hospital. If you have hospital indemnity insurance and do not go to the hospital, you will not get paid benefits. However, accident insurance plans apply to both hospital stays and treatment from your primary care doctor. Consider a few things before you make your decisions.

CONSIDER YOUR LIFESTYLE

Do you enjoy running, hiking, and other activities that may be more prone to accidents? Accident insurance might be your best choice.

Do you have kids who play sports or are constantly playing outside? Accident insurance may be for you. If you lead a relatively healthy, active lifestyle, accident insurance might be a better option for you.

If you have a chronic health issue or have dependents with chronic health issues, hospital indemnity insurance may be a better bet for you.

HOW MUCH MONEY DO YOU NEED TO GET BY?

If you live alone or if you are a relatively young person with fewer financial responsibilities, accident insurance is a great option to ensure you are covered for whatever comes your way.

Sometimes, the best solution may be to have both coverage options. If you have children, own a home, own a car, and have other expenses, purchasing both will give you the best coverage.

CONSIDER HOW MUCH YOU HAVE SAVED FOR EMERGENCIES

If you don’t have a large amount of savings, (e.g. enough to cover three months of expenses), a small monthly premium for accident insurance may make sense for you. On the other hand, if you have enough money to cover potential accident expenses or medical expenses, and support your lifestyle, but a large hospital bill might drain your savings, hospital indemnity insurance may be the smarter option.

Curious about other benefit plan options available to you? Read our article about voluntary affordable benefits here.