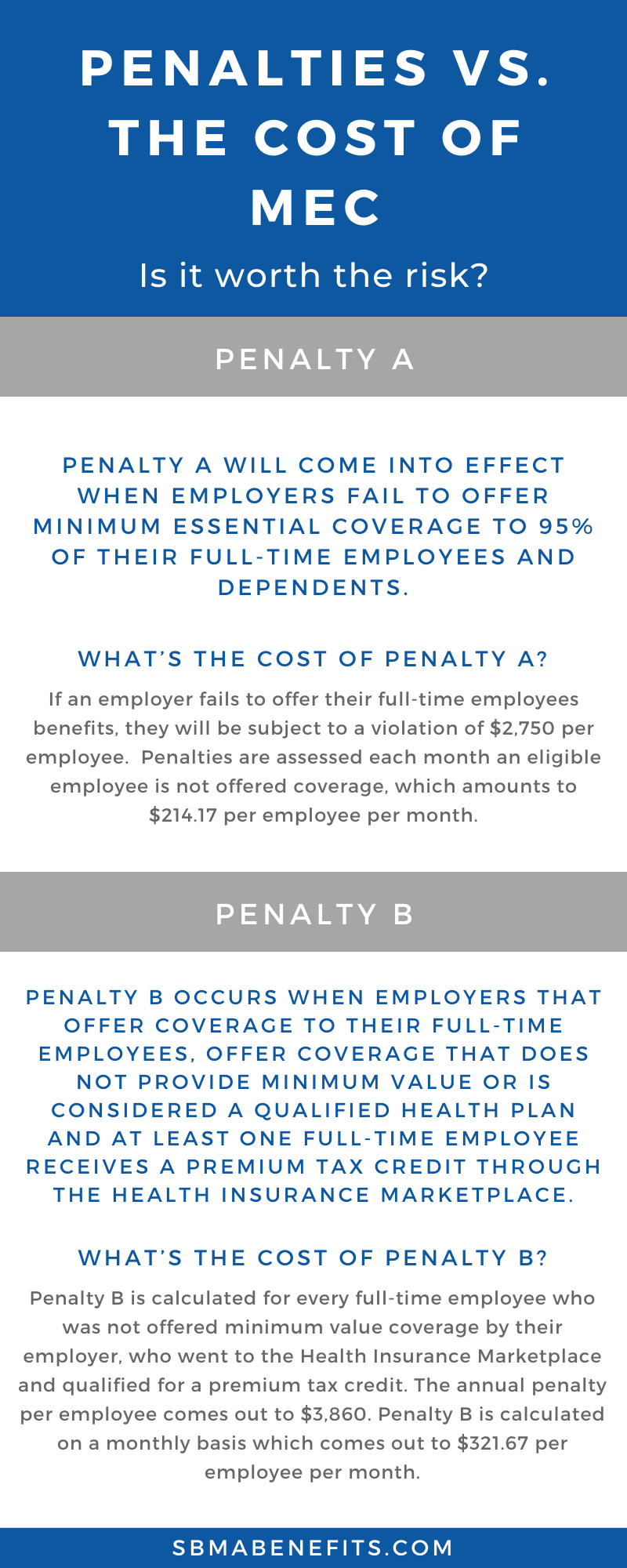

What’s the cost of Penalty A?

If an employer fails to offer their full-time employees benefits, they will be subject to a violation of $2,750 per employee. Penalties are assessed each month an eligible employee is not offered coverage, which amounts to $214.17 per employee per month. If you are a large employer with 5,000 employees and you fail to provide proper benefits for your employees, you could be subject to a $12,7772,900 fine annually.

Penalty B under the ACA

Penalty B occurs when employers that offer coverage to their full-time employees, offer coverage that does not provide minimum value or is considered a qualified health plan and at least one full-time employee receives a premium tax credit through the Health Insurance Marketplace.

What is the minimum value?

The minimum value is that standard for minimum coverage that applies to job-based health plans. In order for a health plan to meet minimum value, it must be designed to pay at least 60% of the total cost of medical services for a standard population, and its benefits must include substantial coverage of physician and inpatient hospital services.

What’s the cost of Penalty B

Penalty B is calculated for every full-time employee who was not offered minimum value coverage by their employer, who went to the Health Insurance Marketplace and qualified for a premium tax credit. The annual penalty per employee comes out to $3,860. Penalty B is calculated on a monthly basis which comes out to $321.67 per employee per month.

For an employer with 5,000 employees, if 100 ACA full-time eligible employees were not offered minimum value coverage, or the coverage was not affordable and they receive a premium tax credit or subsidy on the exchange, employers would be liable for $386,000 annually.

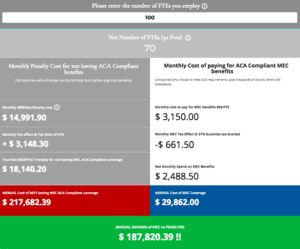

Calculate how much you can save by investing in minimum essential coverage by using the MEC calculator below.